Investing in real estate and other alternatives to stocks or bonds can help you create a diversified portfolio and potentially earn higher returns. However, if you’re investing with a traditional brokerage or even an online brokerage or robo-advisor, your options may be limited.

What Is Yieldstreet?

Yieldstreet is an online platform that offers alternative investment opportunities to eligible investors. Yieldstreet’s individual offerings might appeal to you if you’re interested in building a custom portfolio through an online financial advisor.

What is Yieldstreet, and is Yieldstreet a legitimate investment vehicle? Get your questions answered with this Yieldstreet review, and learn more about how this platform’s financial advisory services work and what you can expect if you decide to invest.

-

- Accredited investors.

- Investors who are interested in owning real estate and other alternatives to stocks and bonds.

- People who have at least $5,000 to invest.

- Individuals who have a longer investment horizon.

- Investors who are seeking above-average return potential.

- Anyone who’s comfortable managing investments online.

- Yieldstreet is a registered investment advisor, but its account options aren’t what you might traditionally encounter at other online brokerages or investment platforms.

When you open a Yieldstreet account, you’re not opening a brokerage account to invest in stocks, mutual funds, exchange-traded funds, or other securities. Instead, you’re specifically opening an account to invest in alternatives to those securities. This Yieldstreet review helps sort it all out.

Yieldstreet’s individual offerings option allows you to build a custom portfolio based on what’s available at any given time. For example, this may include real estate funds, short-term notes, or supply chain financing. The common theme is that all investments you make with Yieldstreet are not your typical online brokerage offerings.

You can open an individual investment account or a Yieldstreet IRA if you’re interested in retirement planning.

Yieldstreet Review: Key Advantages of Yieldstreet Financial Advisor

Generally speaking, there are some advantages of using stock alternatives to invest. For example, you can reap the benefits of holding real estate investments without having to own property.

Depending on what you invest in, you may realize returns that are significantly higher than those generated by stocks or ETFs. An alternative investment platform may be a fee-friendly financial advisor option.

So, what makes Yieldstreet an attractive choice for investing? Our Yieldstreet review found some of the key benefits you should know about:

-

- Invest with as little as $5,000.

- Access a wide variety of alternative investments and asset classes.

- Investments are backed by assets, which may offer protection in the event of defaults.

One thing to know about Yieldstreet’s individual offerings is that they aren’t available to every investor. You must be an accredited investor to open an account and add individual offerings to your portfolio.

How to qualify as an accredited investor

To qualify as an accredited investor, you must either have a $1 million net worth or have an income of $200,000 or more for the previous two years. The income requirement increases to $300,000 per year for married couples who file a joint return.

Yieldstreet verifies your accredited investor status before you can open an account. If you don’t meet the SEC’s requirements to be an accredited investor, then you won’t be able to invest in individual offerings. You can, however, invest in the Yieldstreet Prism Fund as a nonaccredited investor. This fund allows you to build a fixed-income portfolio with a minimum investment of just $1,000.

How Yieldstreet Financial Advisor Works

Yieldstreet’s individual offerings option allows you to invest in a curated list of alternative investments. The minimum investment is $5,000, though some investments may require you to have $10,000 or even $25,000 to get started.

In terms of what you can invest in, Yieldstreet individual offerings span a number of alternative asset classes, including:

-

- Real estate

- Legal finance

- Marine finance

- Commercial finance

- Consumer finance

- Art finance

As you read this Yieldstreet review, it’s important to note that you can pick and choose which investments you’d like to add to your portfolio depending on what’s available and your risk tolerance, time horizon, and goals.

Yieldstreet collects an average annual management fee of 1%-2% from its investors. The actual fees you’ll pay are disclosed on individual offering pages on Yieldstreet’s website. Investors may also pay a flat fund fee per investment, depending on what they invest in.

Is Yieldstreet a legitimate investment platform? In a nutshell, yes. It’s a legitimate way to invest in alternatives to stocks o

What to Look for When Shopping for an Alternative Investment Platform

What is a financial advisor, and how does working with an online financial advisor differ?

A financial advisor is a financial professional who offers advice and guidance in a variety of areas, including budget, investing, and retirement planning. An online financial advisor offers those services online versus in-person.

Yieldstreet financial advisor services don’t fit the traditional financial advisor mold. As you look for an online investment platform, it’s important to keep in mind how they compare to other financial advisory services.

Here are some key considerations to include in your search that should apply to your search beyond this Yieldstreet review:

Cost

When investing with an online platform versus a traditional financial advisor, it’s important to consider what you’ll pay in fees.

Yieldstreet fees are relatively transparent, but if you must dig to find out what you’ll pay with another online advisor, that’s a sign that they may not be a good fit.

Keep in mind that individual offerings may have their own fees in addition to the management fee you’ll pay to the platform.

Account Types

Online investment platforms can offer different account types, including taxable investment accounts as well as individual retirement accounts. With Yieldstreet, you can open a taxable account or an IRA, depending on your needs. However, it’s important to consider what type of variety other online investment platforms offer.

Investment Selection

With Yieldstreet, investors have a wide range of choices for what to invest in, which can make diversification easier. As you research online platforms for alternative investing, consider how diverse the options are. Also, consider each investment’s risk and reward profile to make sure it’s a match for your needs and goals.

Customer Service and Support

If you have an issue or question about your brokerage account, it’s important to be able to connect with customer support when you need it. Consider what type of customer support options are on tap and when help is available.

Educational Resources

Investing in alternatives to stocks, bonds, and mutual funds can carry different risks that you may not be aware of. So, consider how transparent an online investment platform is when it comes to educating investors about its different offerings. This can help with making informed decisions about where to put your money.

Online and Mobile Access

If you’re investing online, you should be able to access your account when you need to, including online or via a mobile app. Yieldstreet allows you to manage your account online and from your mobile device with an easy-to-navigate interface. But consider how other online investment platforms measure up when it comes to online and mobile user experience.

Also, consider things like investment minimums and who can open an account. With Yieldstreet, for instance, individual offerings are limited to accredited investors only unless you’re investing in the Prism Fund. At a minimum, you’ll need at least $5,000 to invest and possibly more. If you’re a novice online investor, a platform that has a lower minimum or fewer requirements regarding accredited investor status may be more appropriate. Reading Yieldstreet reviews like this one can help you decide if it’s a suitable place to invest.

Pros (Benefits) of Yieldstreet

Yieldstreet provides accredited and non-accedited investors access to a wide array of private alternative investments.

I’d go so far as to say Yieldstreet offers more asset classes than most platforms out there, including real estate, crypto, transportation, venture capital, short term notes, art, private equity, structured notes, private credit, and diversified funds.

Can you make money with Yieldstreet? This is another reason I like the platform. Private market investments offer potentially higher returns given their limited availability.

Yieldstreet’s IRAs give investors access to the unique opportunity to hold private investments within a tax-efficient retirement account. Most large traditional brokerage firms do not allow privately held investments.

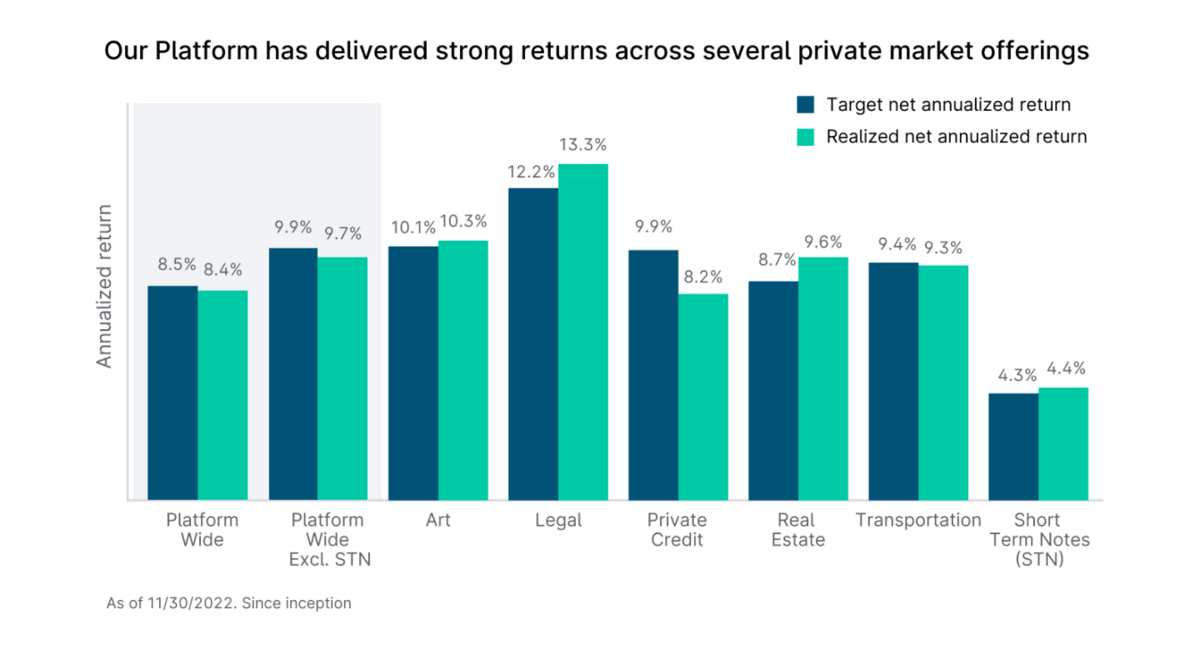

Yieldstreet also prides itself on its transparency. You can view historical performance since inception for each asset class. Out of the billions of dollars in opportunities submitted to Yieldstreet, only 9% make it to investors. Their 30+ person investment team has a four-step vetting process to approve offerings.

Cons (Drawbacks) of Yieldstreet

The primary drawbacks of Yieldstreet are accessibility and liquidity.

Most of what Yieldstreet offers is primarily available to accredited investors. That said, the Yieldstreet Alternative Income Fund was launched for non-accredited investors and charges a 1.0% annual fee. The fund has a $10,000 minimum and invests across multiple of Yieldstreet’s most popular asset classes.

If you’re looking for liquidity, Yieldstreet may not be right for you. The accredited investor offerings range from 6 month to 5 year terms. Again, the Yieldstreet Prism Fund allows investors the opportunity to liquidate at least a portion of their shares on a quarterly basis.

Another main drawback is the limited amount of offerings. Not only are most available to accredited investors, but they are only open for a limited time. You could be ready to invest and find out the fund you’re interested in is already closed.

What kinds of investments are offered?

You can find details about each of the investments Yieldstreet offers on its website. Currently, it offers investments in Real Estate Investment Trusts (REITs), art, supply chain finance investing and more. You can find details on the offering size, maximum and minimum acceptable investments, the expected annual investment return and duration. The platform will also explain the risks of the investment and any favorable highlights.

Notes are another form of alternative investment offered by Yieldstreet. A note is an obligation for a borrower to repay a sum of money with interest within a certain time frame, like six months or one year — similar to the way a loan works. In this case, individuals are investing in the likelihood that they will earn a return for lending money to a borrower.

Those who invest money into the short-term or structured notes offered by the site earn a return on their investment and interest payments over the life of the loans — but it is important to mention that there is always the risk of default. Because of this, every investment offering on Yieldstreet is backed by underlying assets, like a legal settlement or real estate, which means the company will have the means to potentially recoup any defaulted loans for financing investments.

For those interested in investing in art, Masterworks is another platform that allows you to invest in pieces from famous artists. You can purchase fractional shares of art for as little as $20. Read more in our Masterworks review.

Fees

Yieldstreet has an annual management fee ranging on average from 0% – 2.5%. There might also be investments with flat annual fees — such fees are disclosed on individual offering pages. Annual fund expenses may also be charged to investors depending on the legal structure of the offering, and specific information about these expenses can also be found on individual offering pages.

Who’s this best for?

Yieldstreet is ideal for accredited investors who want to diversify their portfolios through alternative investments. Non-accredited investors are also accommodated on the platform through the Prism Fund, however, it’s important to make sure that you have already exhausted other traditional investment accounts first.

Because you might need to lock up your cash for potentially long periods of time, you’ll want to be relatively stable in your current financial situation. It’s important that before you get into alternative investments, you should have a fully funded emergency fund, be contributing at least enough to receive the employer match for your 401(k), contributing to a Roth IRA and have a cushion of extra savings on the side.

It may be worth considering using a robo-advisor, like Wealthfront or Betterment, to invest your money before you start purchasing alternative investments. The platforms will create a diversified portfolio of ETFs for you based on your risk tolerance and investment time horizon.